maricopa county tax lien foreclosure process

When a lien is auctioned it is possible for the bidder to. Introduction to Tax Lien Foreclosures In Arizona tax liens are sold at a public auction every February.

Auctions Leases Maricopa County Az

Ad Search Maricopa County Records Online - Results In Minutes.

. Process of foreclosing tax lien. Maricopa county tax lien foreclosure process. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale. That would mean that as of 2013 you can foreclosure any tax lien certificate purchased in 2010.

Maricopa County AZ currently has 402 tax liens available as of January 14. All groups and messages. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

You have to wait three years after you buy the tax lien certificates to foreclose. Enter the address or street intersection to search for and then click on Go. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus. Ad Be Your Own Detective. This property is Tax Lien with an estimated market value of 3827.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Search For Lien Property Tax Pre-Foreclosure Info Today. Many people think that irs liens have higher priority.

Every year the counties have auctions to sell these unpaid property tax liens. This should meet all statutory requirements of the tax lien. Select the township range and section to search for and.

There is a three-fold process to obtain a deed for a tax lien certificate. In fact maricopa county has an online auction every year in february. This Mobile Home is located at W Pony Rd Maricopa AZ 85139.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Quickly Search Lien Information On A Homeowners Property. Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose.

Do not include city or apartmentsuite numbers. In fact Maricopa County has an online auction every year in February. This process is dictated by state statutes and requires that the tax lien holder send out a notice to the property owner of his or her intent to foreclose on the tax lien.

What is the tax deed process. For example Maricopa County conducts its on-line auction in February of each. Process of foreclosing tax lien.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Maricopa County AZ currently has 22642 tax liens available as of February 14. In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest.

Prior to initiating the court action the CP holder is required to give the property owner a minimum of thirty days notice by certified mail of the impending foreclosure. After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property. It is often considered to be a last resort to get people to pay up the taxes that they owe.

Ad Find Tax Lien Property Under Market Value in Maricopa. The amount owed in taxes becomes the amount of the lien but the interest rate is generally determined by the bidding process at the sale--investors bid down the interest rate in whole numbers starting at 16. However three years after the tax lien is first offered for sale by the Treasurer the owner of a tax lien may commence a tax lien foreclosure action in the county superior court.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. First you need to prepare a 30-day demand letter.

Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders. Enter the Assessor Parcel Number APN to search for and then click on Go. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

However if you buy subsequent tax liens on the same property you. However some of the other counties may sell tax lien certificates separately. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales.

Save money on this. Find Maricopa County Records Info From 2021. The attorneys here have been involved with a form of Arizona real estate investment known as Certificates of Purchase CP or real property tax liens for the past twenty-four years.

Enter the property owner to search for and then click on Go.

How Do I Pay My Taxes Maricopa County Assessor S Office

News Flash Maricopa County Attorney S Office Az Civicengage

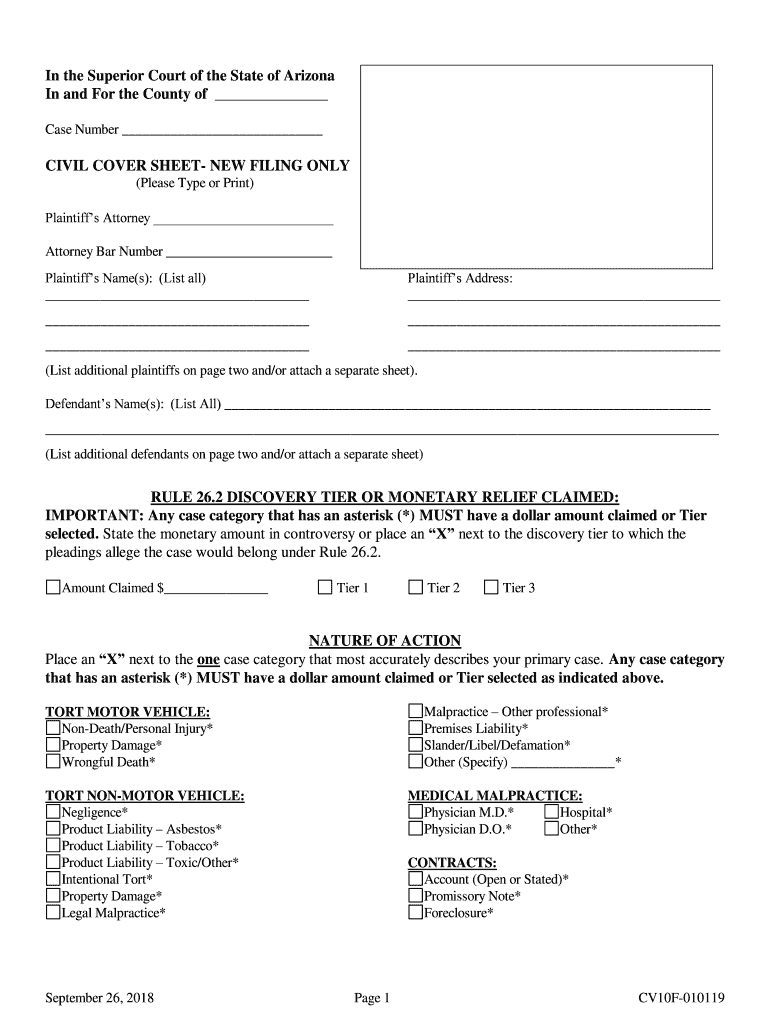

2018 2022 Form Az Cv10f Fill Online Printable Fillable Blank Pdffiller

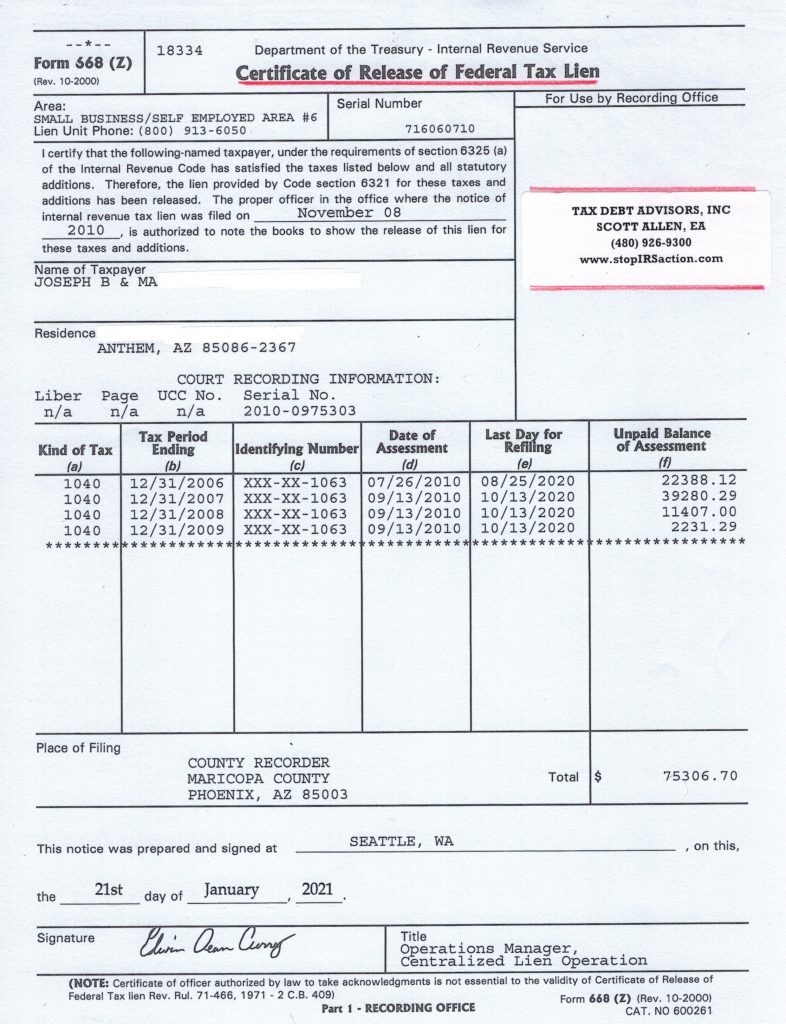

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Arizona Federal Loan Information Fhlc

How Do I Pay My Taxes Maricopa County Assessor S Office

Maricopa County Treasurer S Office John M Allen Treasurer

How Do I Pay My Taxes Maricopa County Assessor S Office

Displaced In America Housing Loss In Maricopa County Arizona

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Island What Is It Arizona Homes Horse Property

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County

Maricopa County Authority To Cancel Notice Of Claim Of Lien Form Arizona Deeds Com

Maricopa County Assessor S Office

Az Maricopa County Contract With Vac Extended Through 5 31 17 Prison Phone Justice

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Maricopa County Will Let Arizona Pot Offenders Off The Hook If They Get Card Phoenix New Times